Services

Audit and Assurance

Audit is the backbone of any organisation for image building and creating trust in the minds of the community at large. Various stakeholders in the organisation viz., share holders, debenture holders, financiers, creditors, credit agencies, government agencies etc. take the informed decisions on the basis of audited financial statements. KASCO helps the business houses in compliance of various statutory requirements, achieving the business objectives and improving the business processes and present true and fair view of the financial statements by providing the various services in the area of Audits. In Audits we provide the following services :

Statutory Audits as per the Companies Act, 2013

Statutory Audits as per the Companies Act, 2013

Statutory Audit as per the Companies Act, 2013

With the enactment of the New Companies Act 2013, the function of audit becomes a very challenging, technical, responsible and highly compliance oriented activity. The auditor has been casted with various disclosure and reporting requirements coupled with huge monetary penalties and punishment of imprisonment. Now the audit of corporates is not a simple job so that anybody can carry out such a responsibility.

KASCO has its own programme of ethics, values through which such highly responsible activity is being performed with utmost care so that the stakeholders of any company shall get true and fair view of the financial statements of the company stappled with highest degree of transparency of the financial statements. We are also eligible to be appointed as statutory auditor of listed companies.

Tax Audits as per the Income Tax Act, 1961

Tax Audits as per the Income Tax Act, 1961

Tax Audits as per the Income Tax Act, 1961

Tax audit requirements under the Income Tax Act, 1961 shall be triggered when the business enterprise hit the total turnover or gross receipts of Rs. 1 Crore (10 Million) and for professionals Rs. 25 Lakhs (2.5 Million) in a particular Financial year i.e. 1ST April to 31ST March. Tax audit report as per the Income Tax Act, 1961 is purely based on the certification of the correctness of the computation of tax after considering the various provisions of Income Tax Act, 1961 coupled with the preparation of financial statements as per the generally accepted Accounting Principles (GAAP).

The Govt. Every year carry out the exercise to extract more useful information from the audit report and hence the disclosure requirements becomes more extensive. KASCO helps the business organisations to disclose true and fair view of the financial statements so that the transparent information shall be disclosed to the Government agencies with correct computation of tax. KASCO follows the inherent risk management tools while fulfilling the reporting requirements, advising the clients in respect of the reporting requirements.

Internal Audits

Internal Audits

Internal Audits

Every business organisation has its internal working system which has its own inherent risks. This risk analysis and management of the risk factors are covered under the Internal Audits. Risk mitigating and the review of internal controls within the organisation are the prime focus in the Internal Audits. Internal Audit reports are relied by the Statutory Auditors also. We at KASCO has a highly qualified and experienced team of professionals who has very rich experience in Internal Audits of various corporate with altogether a different nature of businesses. Our experienced and highly motivated team of professionals work in the business organisations having diversified activities.

Audits of Nationalised, Private & Co. Op. Banks

Audits of Nationalised, Private & Co. Op. Banks

Audits of Nationalised, Private & Co. Op. Banks

Banking sector is the most important in the economy of any country. Security, Management & Utilisation of public money is the biggest headache for any government. In present days, every government department is answerable to CAG for the above three aspects associated with public money. Management of Banks are also answerable in the same way to government departments & RBI. To ensure the prudent management of public money at micro level in the banking sector, Chartered Accountants are entrusted for the conducting of various audits viz. Statutory, Concurrent, Revenue, Stock, Book Debt, Inspection of Securities etc. We at KASCO are empanelled with RBI for the conduct of these audits of nationalised & private banks. We are also empanelled with Registrar of Co-operative Societies for the conduct of audits of Co-operative banks. We have a rich experience of conducting concurrent, revenue & statutory audits of more than 10 years.

Internal and Concurrent Audits

Internal and Concurrent Audits

Internal and Concurrent Audits

In India SEBI is the regulator in Capital Market. Its an autonomous body. SEBI regulates all the transactions of Stock market, Commodity market, Mutual fund industry etc. It has its own code of conduct and audit mechanism. All the stock brokers, Depositories in India are covered under the regulation of SEBI. NSDL is one of the Depositories in India along with CDSL. NSDL is very stringent in the Audit mechanism of Depository Participants registered with it. It has developed the system of Concurrent and Internal Audit of all the Participants along with regular inspection of the Participants. KASCO has gained a very rich experience in this very sophisticated field of audit and inspection. One of the managing partners of KASCO is qualified auditor with certification from NISM.

Statutory Audits as per The Indian Co-op Societies Act

Statutory Audits as per The Indian Co-op Societies Act

Statutory Audits as per The Indian Co-op Societies Act

In India Co-op Societies culture is widely spread mostly in western region of the Country. So many Co-op. Societies are being registered and operated in this region having their activities as Co. op. Housing Societies, maintenance societies, Co. op. consumer societies, Employees welfare societies, Soc, Agricultural product societies, Societies carrying out the activities of money lending, Sugar Factories, Milk production and marketing Societies, APMCs, Co. op. Banks etc. Since last more than 12 years, KASCO has been empanelled with the Registrar of Co. op. Societies and carrying out the statutory audits of various Co. op. Societies. We at KASCO has a very powerful team of professionals who carry out the statutory audit of such Co. op. Societies as per the requirements of Law governing the functions of such Co. op. Societies.

Statutory Audits of NGOs, Public Trusts

Statutory Audits of NGOs, Public Trusts

Statutory Audits of NGOs, Public Trusts

In India NGOs and Public Trusts are registered and carry out thousands of noble activities across the country. These NGOs are involved in various activities of public interests at large. At some places, these NGOs provide the platform for the implementation of various Government Schemes for the weaker section of the Society. In India Public Trusts are of two types. One is The Public Charitable Trusts and the other are Public Religious Trusts. Charitable Trusts carry out the activities relating to the benefit of the public at large in the form of charitable activities whereas the Public Religious Trusts carry out the activities relating to the religion. All these trusts, NGOs have to get themselves registered with the authorities and have to compulsorily follow the system of Audits. KASCO is one of the authorities in the audits of such NGOs and Public Trusts in the region. Our team of highly qualified professionals has the presence in this field of Audits for more than 40 years. By carrying out the audits of such NGOs, and Public Trusts, we certify the use of the funds and the activities which is very helpful for the Government Authorities for taking an informed decision in allowing various tax benefits as well as privileges to these NGOs and Public Trusts. The activities of such organisations are also covered under CSR.

VAT Audits under the VAT laws of various states

VAT Audits under the VAT laws of various states

VAT Audits under the VAT laws of various states

VAT laws at present vary from State to State in India. Every state has its own provisions regarding Audit under the respective VAT law of that particular state. VAT audit ensures that the dealer has correctly paid the taxes due on various transactions, has correctly availed the Input Credit, Interstate sales and purchases have been correctly recorded in the books of accounts and most importantly, it ensures the credibility of data provided by the dealer in his various monthly / quarterly / annual VAT returns. At KASCO we carry out the VAT audits as per the VAT laws. The client shall get surety that whatever data has been supplied by him to VAT department during the course of filing of various periodical returns, have been properly compiled and any discrepancy left shall be corrected before assessment proceedings by the VAT department. At KASCO, we follow data integration module while carrying out VAT Audit so that the information supplied to one Govt. Department shall not create any conflict with those supplied to other department.

Central Excise Audit

Central Excise Audit

Central Excise Audit

Normally the audit under the Central Excise Act are being carried out by the departmental authorities as per the prescribed guidelines in this respect. When department carries out the audit and if any anomaly is found in respect of non-payment / short payment of excise Duty or availment of wrong Cenvat Credit etc., then the tax along with interest and penalty shall be levied. To avoid such a situation we at KASCO follow the system of Central Excise audit on the concept of "Precaution is better than cure."

Service tax Audit

Service tax Audit

Service tax Audit

As per the prescribed guidelines under the Finance Act 1994, the departmental officers shall carry out the Service tax audit by selecting various service providers. During the course of such audit by the department, if any short payment / non-payment of service tax or interest is found or if any wrong availment of wrong CENVAT Credit is found, it leads to payment of Service tax along with interest and penalty. Service tax is one of the toughest laws in India involving therein so many services, legal interpretations etc. that it is always better to be clean rather than to get clean after being caught. We at KASCO, follow this fundamental principle and carry out the Service tax audit and advise the clients to remain clean. We at KASCO carry out the service tax audit by following data integration model and advise clients to get themselves secured.

Accounting Compliances and reporting

Accounting Compliances and reporting

Accounting Compliances and reporting

Accounting profession nowadays become the most transforming profession all over the globe after introduction of IFRS which is going to be the common language of accounting around the world. The field of Accounting has undergone a paradigm shift with the introduction of various disclosure requirements for the corporate, mandatory implementation of various accounting standards even for non-corporates. As far as India is concerned, after introduction of The Companies Act, 2013, the disclosure requirements and the implementation of Accounting Standards, has created a buzz in the Accounting field and the same shall be more intense in the time to come. Compliance and reporting on various accounting policies and procedures are made more stringent and implementation of accounting standards is the need of the day. This requires a very thorough knowledge with high standards of professionalism. KASCO provides the team of professionals with in-depth knowledge of various accounting compliances and the procedures to be followed for effective and correct reporting on this front. We help our client to understand the need of accounting and streamline the accounting procedures. We make them educated to keep the pace with the latest developments so that they can stay in the globally competitive market. We guide and help in formulating Accounting and Auditing committee in their organisation.

Compliance with IND AS and Convergence with IFRS

Compliance with IND AS and Convergence with IFRS

Compliance with IND AS and Convergence with IFRS

IFRS is the global Accounting language at present. More and more countries are accepting the IFRS as their accounting reporting language. Today we live in a global village. Cross border transactions and presence of any business organisation is not a big thing today. In such a situation the common accounting language is the need of the day and IFRS has fulfilled the same. Complexities in the business operations demand constant upgradation in accounting treatment of various transactions. India is one of the most rapidly developing economies of the World. More and more MNCs are coming to India to lure the benefits of the large and young consumer market. Indian Companies also becoming giant and acquiring various businesses across the globe. Hence the need to follow IFRS is increasing . In India IND AS have been introduced to keep pace with IFRS. Its acceptance is widening day by day. KASCO has the team of highly professionalised team which helps the clients to understand the impact of IND AS and IFRS. The reporting requirements and the impact on the Financial results. KASCO provides the clients and their accounting personnel, directors etc. a very well-versed team of professional who helps them to implement the accounting standards, their compliance and reporting requirements. We at KASCO help our clients to transform themselves from age old accounting system to new age globally accepted accounting system.

Taxation Services

Taxation has always been a ticklish issue around the world. Over the globe, taxation is becoming more and more complex. Tax practice, today demands a well versed and in-depth interpretational skills with strategic planning. Today, while delivering tax advisory, a professional has to strive a balance between various taxation laws and their conflicting provisions. Business organisations nowadays do not operate in one particular boundary and hence they are exposed to various taxation threats. This created the need for multi-dimensional tax advisory services. At KASCO, we have in-house team of professionals who delivers the direct, Indirect, And International, personalised taxation and transfer pricing issues. KASCO follow an umbrella approach in the tax advisory services. We at KASCO dissect the taxation issue to have a microscopic analysis of the same. We advise the clients on their issues keeping in view various taxation provisions of different tax laws. Our Tax practice is organised in such a way that seamless services are being tendered to our clients. Our commitment to exceptional client service is guided by quality, insight and responsiveness. We at KASCO deliver the following tax advisory services:

Direct Tax Advisory Service

Direct Tax Advisory Service

Direct Tax Advisory Service

Direct tax covers mainly Income Tax, MAT (Minimum Alternative Tax), AMT (Alternate Minimum Tax), DDT (Dividend Distribution Tax), Tonnage Tax, presumptive tax, TDS, TCS Wealth tax etc. in India. All these taxes have their own applicability but amongst all Income tax is the common. At KASCO we provide well-guided advisory services to our clients in the field of Direct Taxation. We strive to understand the need of the client in terms of business transactions and then develop the solution with utmost care and insight which meets the client’s needs.

Indirect Tax Advisory Service

Indirect Tax Advisory Service

Indirect Tax Advisory Service

Mainly in India, indirect tax regime covers Customs, Central Excise, Service Tax, VAT, Central Sales tax etc. Indirect tax have in some cases cascading effect on the business transactions. With the introduction of GST (Goods and Services Tax) in India, a major taxation reform shall take place in the history of the country. Indirect taxes by their very nature are the most rapidly changing taxes. We have to keep the track on various amendments which are introduced through notifications and circulars. We at KASCO, have a separate team of professionals to cater the need of clients in the field of Indirect Taxation. KASCO developed in-house module that blend the direct and indirect advisory in such a way that the clients shall get a 360 degree understanding of taxation on a particular business transaction. This helps the client to take an informed decision.

International Tax Advisory Service

International Tax Advisory Service

International Tax Advisory Service

Today we live in a global village. For business organisations, the physical boundaries of various sovereign nations are of not much importance. Business organisation in one country may have various establishments and interests across the globe. Even these establishments transact also in monetary terms. The importance of valuation of these transactions is much for each sovereign nations so that they can tax the income earned by the business organisation on their soil. At the same time it is also important to see that the same business transaction shall not be taxed more than once at different soils. Here KASCO comes at the rescue of our clients. We have a team of professionals who have understanding of various Cross Nation Treaties. We at KASCO describe our clients regarding the impact of the taxation of their cross border transaction and keep them updated in respect of the changes in the global business and tax scenario.

Transfer Pricing Services

Transfer Pricing Services

Transfer Pricing Services

Today Business relationships between two organisations are so complex and the tax laws are more complex than it. Any transactions which involves two associated enterprise attract the transfer pricing regulations. The transactions between such enterprises must be carried out at Arm’s length Price. At KASCO, we guide the clients how to carry out the transactions at Arm’s Length Price, how to keep proper documentation in respect of such transactions, the compliance requirements of such transactions. We cater the need of our clients with thorough understanding of the nature of transactions entered by them with associated people. Our responsiveness towards the problem of our client in this area is centred on the understanding of the nature of transactions, the relationship of transacting concerns etc.

Personal Tax Advisory

Personal Tax Advisory

Personal Tax Advisory

Taxation is always a hole in the pocket when it comes to personal tax. As a human being we always have the tendency to pay less tax as much as possible. In the field of personal tax advisory we at KASCO understand the need of our clients who are individual tax payers. We guide them for various tax shield Investment avenues to reduce their tax bill. We at KASCO has developed an advisory system for the NRIs and investment opportunities to them. KASCO caters the taxation issues of expatriates also.

Tax Planning

Tax Planning

Tax Planning

Any business organisation always try to keep their tax bill as low as possible. Here Tax planning comes into play. KASCO has a very clear cut internal guidelines to the professionals and employees that KASCO always avoids Tax avoidance. Tax planning is always legitimate when it is followed within four corners of the taxation laws. Tax planning requires novel ideas, correct interpretation of tax statues with backing of various legislative precedents. This requires a constant updating of knowledge on taxation laws. KASCO has an in-built programme of all round professional development of the professional team as well as the employees. This makes them aware of the latest amendments and the interpretation of various provisions of tax laws. We at KASCO provide advisory in this area after consistently and continuously tracking the various precedents of various Courts of law and the amendments made to the taxation laws. KASCO has the team of highly experienced professionals who have a very rich treasure of more than 15 years of experience in this field.

Tax representation Service

Tax representation Service

Tax representation Service

Taxation has always been a battle field between the tax payers and the tax collectors. Ambiguity in the tax provisions add fuel to it. Various appellate forums have been formed to settle the issues between the tax payers and the tax collectors. KASCO provides the services to represent the client’s tax issue at various appellate forums. KASCO has developed the network of professional firms for the representation of tax issues at higher forums. Professional team of KASCO always strive to get the justice for its clients by representing the client at various levels and present the case of the client with accuracy, judicious analysis and professionalism.

Tax Accounting Service

Tax Accounting Service

Tax Accounting Service

Today the business and tax environment are very complex. There is an increasing need for more and more transparent data from the business organisation while computing their tax outflows. All taxes are on Self-assessment mode and hence the responsibility on the business organisation has been increased manifold to calculate their taxes in a correct manner. Even the tax departments are also under pressure to be more effective in tax collection. Here KASCO comes in to the picture. We at KASCO have developed a highly sophisticated system of tax computation on monthly / quarterly / annually as per the need of the client and the tax laws. We provide the clients all assistance in the correct tax computation of their business transactions. We provide our clients all round assistance in recording of various business transactions by following various accounting standards so that the same are in line with the tax accounting standards. We at KASCO developed the system to reconcile the deviations also.

Corporate Advisory and Structuring

In today's business world, we you have to be big then you have to think big and you have to really become big in terms of all the areas whether it is volume of business, geographical area of business, finance, tax compliance, accounting compliance, strategic management, responsibility or anything else. For expansion and development the business organisation has to streamline its business operations, internal controls and management. It has to develop various systems and follow those systems. If any business organisation wants to survive and achieve its relative importance, it has to think beyond the conservative approach. For this, business organisation has to transform itself. It can be achieved in the form of change of the business structure. If any business organisation is presently running in Proprietorship or simple partnership form then due to the change in the business circumstances, it may have to transform into an LLP or a Private Limited or Public Limited Company. We at KASCO provide this transformation services. We make our clients understand that the need of their business is to move ahead. Age old static format of doing business is an old era now. KASCO through its highly adaptive and interactive strategy guides its clients to grow in terms of size, volume, financial strength, geographical presence, responsible behaviour. For this we provide a blend of services of advisory and structuring. It includes formation of a Company or LLP in India or outside India, Conversion from partnership or proprietorship to Company or LLP, Corporate secretarial services by in-house Company Secretary. We at KASCO through our team of highly skilled professionals provide our clients various advisory services in the area of Securities listing, IPOs etc. We also guide our clients in demerger, Merger and Acquisitions, debt re-structuring etc.

Specialised Consulting Services

In present time the business environment is very fast changing and has to be adaptive to the changing environment. Today the complexities of various laws, business management techniques, accounting methodologies and concepts have increased manifold. Any business organisation has to invariably undergo all these change process. For this, there is always the need to understand the impact of the changes as well as the cost and complexities of the processes. This require the painstaking analysis with the help of professionally qualified team. KASCO has such professionally qualified team of persons who can develop the system, procedures for any business organisation after understanding the need and appetite of the business organisation. Today if any business organisation wants to grow then it has to strengthen its internal and inherent weaknesses. It has to streamline the processes and at the same time it has to make a cost benefit analysis of the adaptive. KASCO bridges this gap in such a way that the business management can take an informed decision. The professionally qualified team of KASCO with its pre-defined standards helps the business organisation in various ways which are as follows:

Formation of various business models

Formation of various business models

Formation of various business model

Every business organisation cannot run its show in one particular format or model. It all depends on the nature of the business, the values set forth by the business organisation, culture of the organisation, management perspective and lot more. We at KASCO understands the need of the organisation and after considering all the factors, we help the management in decision making of formation of business model. We steer the management by analysing various options of business models in such a way that suits their need to the best.

Business Transaction agreements

Business Transaction agreements

Business Transaction agreements

In present era the business organisation enters into various transactions on routine basis during the normal course of business. It may be with employees, professionals, suppliers, customers, service providers, partners, joint ventures, and other stake holders. The transactions entered into with such persons are need to be inked to give it a legal enforceability. Smartly drafted agreements provide the shield to the organisation in case of contingencies. KASCO with its experienced team of professionals provides the protection wall to the business organisation towards unforeseen events by helping them out in jolting down various business agreements. Business agreements if properly drafted make the transaction very transparent and it makes the dealing much easier. We at KASCO have adopted one of our ethics as transparency and the same we put into practice also.

Wills and family arrangements

Wills and family arrangements

Wills and family arrangements

Any human being who has taken birth on this globe has to depart at one time. There is always an exit for each and every person. It's our human nature that we want to make it sure that the legacy should continue after the death. Every person with considerable wealth shall have the feeling that after his departure, the family should not get disturbed and shall have the fair and happy life to live. To avoid any legal disputes and unrest among the family members after the exit of the head, proper arrangement and allocation of various wealth should be made. Family arrangements and Wills are the solutions to this worry. We at KASCO, provide our client such valuable services in respect of preparation of Will and family arrangements to avoid the legal tussles among the family members. Same is the situation when any business organisation is family run. We at KASCO provide the services which help the business organisation to remain in motion without being indulged in any legal battle.

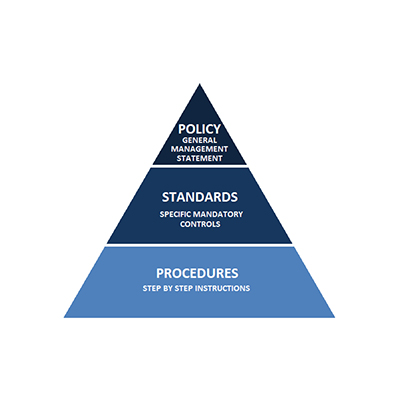

Standards and operating Procedures Manual

Standards and operating Procedures Manual

Standards and operating Procedures Manual

Today any business organisation has to work in specific discipline format. The business discipline is a pre-condition for any business organisation to have better internal control, role specification of employees. We at KASCO have the vast experience in preparing and implementing various Standards and Operating Procedures. It’s not enough to simply prepare such standards and operating procedures. The implementation is also very much needed but the effective implementation can be achieved only through manual of such standards and procedures. We at KASCO have successfully developed and implemented such SOPs with standardised manual so that the business organisation has the ready reckoner of what to follow, how to follow, who has to follow and when to follow.

Structuring Employees Taxation

Structuring Employees Taxation

Structuring Employees Taxation

In any business organisation, its employees are the driving force. They are the human assets of the business organisation. Employees are always concerned with the take home salary along with the perks. In taxation laws the employees are given various tax soaps. They have very limited resources to explore and reduce the tax bill so that their take home salary can be maximised. At the same time, the business organisation always thinks to give more benefits to the employees so that their morale will not get adverse. KASCO helps the business organisation to structure the salary in such a way that the employees shall be benefited at the most and at the same time business organisation shall not have any legal trauma. KASCO guides the business entities to achieve this balance with various solutions without compromising the legal provisions.

Internal controls in the organisation

Internal controls in the organisation

Internal controls in the organisation

In recent times the business organisations have undergone a drastic change due to technology up-gradation and rise in the complexities of business environment. Due to expansion in size, geographical areas etc. the business organisations have to work hard on their internal control mechanism. Business houses have to review their internal controls at regular intervals. For any business house Internal controls are the most important check mechanism against the inherent and internal risks. We at KASCO help the business houses in implementation of internal controls to strengthen their internal work processes and provide them the shield against the internal risks. KASCO, with the help of its professional team has developed the review mechanism of internal controls in business organisation. Our team of professionals helps the business houses to analyse the drawbacks in the existing internal controls and suggest the best possible alternate therapy to cure the disease prevailing in the internal controls.

Financial Process Outsourcing

Financial Process Outsourcing

Financial Process Outsourcing

Outsourcing is the best possible way to control the costs in many field. Today the business processes along with the financial compliances become so complex that it requires the personnel with high degree of knowledge with practical implications. For business organisations, to recruit such personnel is a tough task and even tougher to retain them for a long period of time. Hence, so many business organisations have chosen to outsource the function of Financial Process. This includes book keeping, records maintenance, preparations of various financial information which is needed by various stake holders. KASCO has successfully delivered the outsourcing results to various clients. With our dedicated team, we at KASCO have developed the facilities for outsourcing of various financial processes of business organisations.

Deal Advisory

Deal Advisory

Deal Advisory

Business organisations have to enter into various deals with so many outsiders, contractors, service providers, suppliers in their normal course of business. Moreover, some business houses are in expansion phase and during this process it may have to come across the situations where it has to take over the business of others. It may have to make strategic partners and JVs. All such activities require a professional and technical support as well. People who are familiar and part of the process of such highly sophisticated activities need the financial and technical support. KASCO has carved out the systems and policies which are deal centric for a business organisation. We make our clients aware about the various aspects of the various deals that they are going to entered into. We carry rounds of consultations with the opposite parties and represent our clients in various deals.

Due Diligence review

Due Diligence review

Due Diligence review

All over the globe, now a day’s business enterprise has to enter into various deals with different entities. IT is very essential that the deals are to be very transparent in all respect. At the same time, the contracting entities has to ensure that the particulars exchanged by them in respect of each other are true in all respect. Hence the exercise of carrying out Due Diligence is a pre-requisite. We at KASCO has a rich experience in Due Diligence which shall be helpful to the contracting entities to take informed decision while entering into a transaction. Independency and transparency is very much required in due diligence process. We at KASCO have a very clear cut code of ethics which is being followed at KASCO in its true sense and at all level we maintain our independency and un-bias opinion while carrying out Due Diligence process. Our professionals are trained in such a way that there should not be a compromise with any of our codes of Ethics. At KASCO we carry out even an independent review of the Due Diligence process.

Information System Review

Information System Review

Information System Review

Today is the era of technology. Techno savvy business entity with high standards of internal control can always be a head of others. Technology has tremendous advantages but at the same time the exposure to the risk is also very high if the technology and systems are not properly shielded by the business enterprise. Today the information and data flow within the entity in digital form. Even the stake holders and Government department also require various information from the business enterprise in digital form. This is a welcome move towards “GO GREEN”. But at the same time it is up to the business entity that how far their computer systems and technologies are secured from the threats so that the vulnerability to the sensitive data can be reduced to the minimum. We at KASCO has the team of professionally qualified members who have vast experience in construction of the system and to make it more secured. KASCO helps the business entities in data storage and security, most efficient use of the information system by the management.

Compliance Review

Compliance Review

Compliance Review

Business enterprise has to comply various laws and requirements even of Accounting Standards and many more. Business is global today. Hence the business enterprise has to comply various international laws also which at many point of time are in conflicts with the local laws and practices. The business enterprise has to carve out a balance between all these odds. Compliance is the best tool to control. Even the business entity has to develop its own internal work procedures. It has to ensure that all departments adhere to the compliance of the internal system and at the same time the compliance enforced by the external agencies is also very important. Lack of compliance within the business organisation creates the culture of irresponsibility which leads to business chaos at the end. Non-compliance to the mandatory procedures prescribed under various laws leads to legal hardship. We at KASCO has developed the system that has created the trained work force which helps the business enterprises to develop the system of error free compliance. KASCO has successfully developed and implemented system in various business organisations which takes care of internal as well as external compliance by any business entity. KASCO also helps you out to identify the shortfalls of the existing system and suggests the best possible alternative to strengthen the compliance procedures. Our team of professionals have also carried out various training sessions for employees of the business organisation so that the sense of responsibility and ownership abilities can be developed among them to strengthen the compliance procedures.